Ichimoku Cloud is a powerful technical analysis tool used by traders to identify potential trading opportunities. The strategy is based on five different lines, each of which provides valuable information about market trends, support, and resistance levels. One of the most popular Ichimoku strategies is the bearish trading strategy.

The first step in implementing the bearish Ichimoku strategy is to check the price location relative to the cloud. When the price is below the cloud, it indicates a bearish sentiment. Conversely, when the price is above the cloud, it suggests a bullish sentiment. The cloud represents support or resistance levels and acts as a significant indicator of market sentiment.

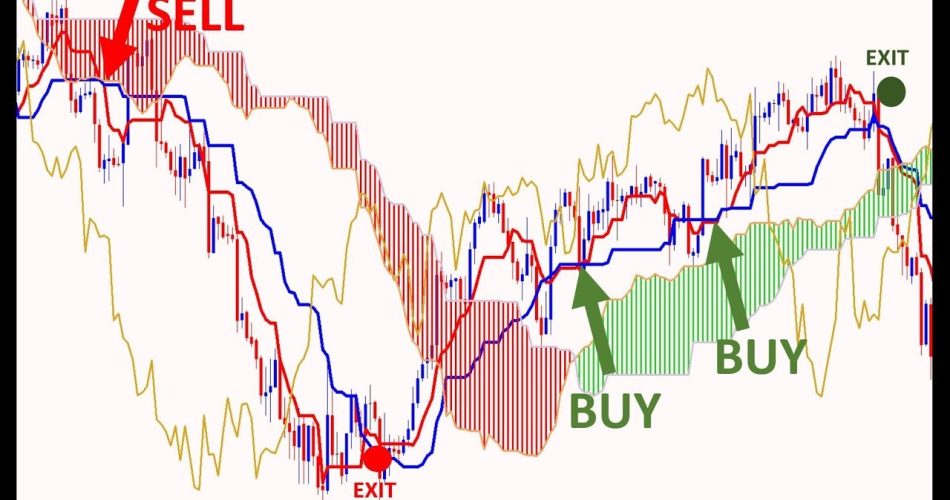

The next step is to look for the bearish crossover of the Tenkan-sen and Kijun-sen. These two lines make up the standard Ichimoku indicator. The Tenkan-sen is the red line, and the Kijun-sen is the blue line. When the Tenkan-sen crosses below the Kijun-sen, it signals a bearish sentiment. This crossover is considered a critical point for initiating a bearish position. Traders typically use the Tenkan-sen and Kijun-sen crossover to confirm the momentum of the bearish trend.

After the Tenkan-sen and Kijun-sen crossover, traders need to confirm the bearish sentiment with the Chikou Span. The Chikou Span is the green line that is plotted 26 periods back. It is used to confirm the overall trend and to identify potential reversal points. When the Chikou Span is below the price and the cloud, it confirms a bearish trend.

The next step is to set your stop-loss level. The stop-loss level is the highest high in the cloud or above the cloud. This level is used to limit the trader’s losses in the event of a reversal. By setting a stop-loss level, traders can protect their capital from significant losses.

The final step is to set your profit target. Traders can use the next support level as their profit target. This level represents the point at which the price is likely to rebound after a decline. By setting a profit target, traders can take advantage of the price movements and maximize their profits.

In summary, the bearish Ichimoku strategy is a powerful tool for traders looking to take advantage of market trends. By following the five steps outlined above, traders can identify potential trading opportunities and maximize their profits while minimizing their risks. However, it is essential to remember that technical analysis is not foolproof, and traders should always do their research and analysis before making any trading decisions. Additionally, traders should manage their risks by using stop-loss orders and not risking more than they can afford to lose.