Welcome back!

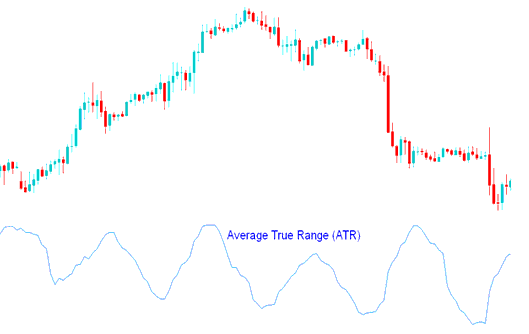

Average True Range Indicator

The Average True Range (ATR) is a technical indicator that measures the volatility of a financial asset. It was developed by J. Welles Wilder Jr. and introduced in his 1978 book, “New Concepts in Technical Trading Systems.”

The ATR is calculated as the average of the true ranges of a set of past periods. The true range of a period is the greatest of the following:

- The difference between the high and the low for the period.

- The absolute value of the difference between the high and the previous close.

- The absolute value of the difference between the low and the previous close.

The ATR is typically calculated using a 14-period moving average. It is expressed in the same units as the asset’s price, and a higher ATR value indicates a higher level of volatility.

Traders and investors can use the ATR to identify trends and make informed decisions about their trades. For example, a trader might use the ATR to determine the appropriate stop-loss level for a trade, or to set a trailing stop to capture profits while minimizing risk. The ATR can also be used to identify potential breakout points or to confirm trends.