Welcome back!

FOREX SPREAD

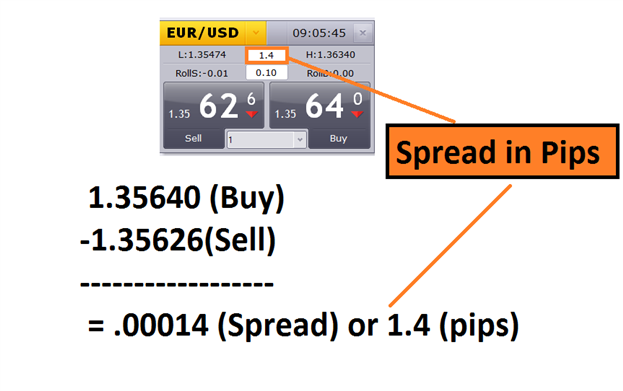

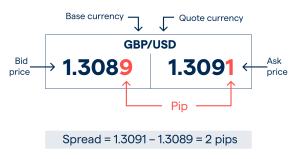

Forex spread refers to the difference between the bid and ask prices of a currency pair in the foreign exchange market. It is the cost incurred by traders for entering into a currency trade and is usually measured in pips. The bid price represents the maximum price a buyer is willing to pay for a currency, while the ask price represents the minimum price a seller is willing to accept for a currency.

The spread can have a significant impact on a trader’s profits and losses, as a larger spread means higher trading costs and a smaller profit margin for each trade. Spreads can vary greatly among different currency pairs, as well as among different forex brokers. Factors such as market volatility, liquidity, and the competitiveness of the market can all affect the size of the spread.

Forex brokers make their profits from the spread, as they buy the currency at the lower bid price and then sell it at the higher ask price. Some brokers may offer fixed spreads, while others may offer variable spreads that can change based on market conditions.

In general, currency pairs with high liquidity, such as the EUR/USD or GBP/USD, tend to have smaller spreads, while less liquid currency pairs, such as the AUD/CAD, may have larger spreads. Moreover, currency pairs with high volatility, such as the USD/JPY, may also have larger spreads due to the increased risk involved in trading them.

Traders can choose to trade with brokers that offer tight spreads, but these brokers may charge higher commissions or have more stringent trading requirements. On the other hand, brokers that offer wider spreads may provide more relaxed trading conditions but will result in higher trading costs for traders.

In conclusion, forex spread is an important factor to consider when choosing a broker and trading in the foreign exchange market. Traders should carefully evaluate the size of the spread and the impact it can have on their trading strategy and profitability. Additionally, they should also consider other factors such as trading conditions, commissions, and platform capabilities when choosing a broker.