Elliot wave theory is a popular technical analysis tool used by traders in forex markets. This theory is based on the idea that market movements follow specific patterns that can be predicted and capitalized upon. Developed by Ralph Nelson Elliot in the 1930s, the theory is based on the premise that market movements are not random but follow specific patterns based on investor psychology.

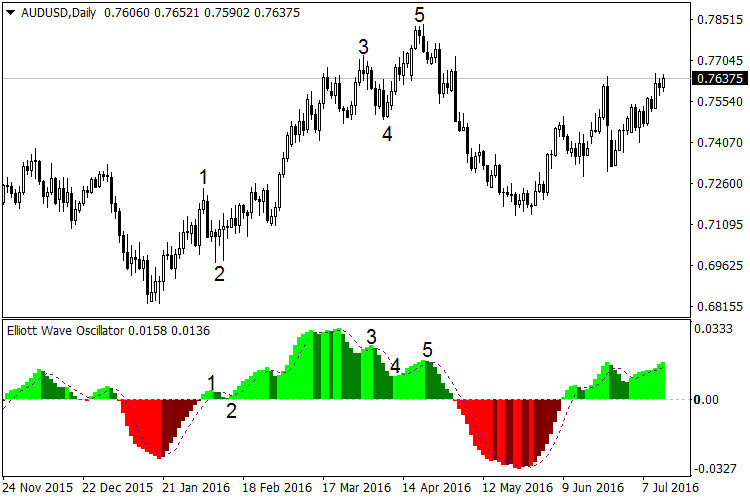

The Elliot wave theory is based on the idea that markets move in a series of five waves in the direction of the trend, followed by three corrective waves against the trend. The first five waves are known as impulse waves, and the three corrective waves are called corrective waves. The first and third waves of an impulse move in the direction of the trend, while the second and fourth waves move against the trend. The fifth wave is the final wave in the impulse, which moves in the direction of the trend.

The three corrective waves, assumed to be A, B and C move against the trend. Wave A moves in the opposite direction of the trend, while wave B retraces some of the gains made in wave A. Wave C is the final corrective wave and moves in the direction of the trend. Once the corrective waves are complete, the market moves in the direction of the impulse wave.

Elliot wave theory can be used to identify the direction of the trend and the levels of support and resistance. Traders can use the theory to identify potential entry and exit points in the market. The theory can also be used to identify potential price targets and the likelihood of a trend reversal.

There are a few key principles to keep in mind when using Elliot wave theory in forex trading. Firstly, the trend is your friend, and it is important to identify the direction of the trend before entering a trade. Secondly, it is important to identify the waves correctly, as mislabeling the waves can lead to incorrect predictions. Finally, it is important to use other technical indicators to confirm the Elliot wave analysis and identify potential trade opportunities.

Elliot wave theory is not without its criticisms, and some traders believe that it is too subjective and open to interpretation. Others argue that it is too complicated and that simpler technical analysis tools are more effective. Despite these criticisms, many traders continue to use Elliot wave theory in their trading strategies, and it remains a popular technical analysis tool in the forex market.